MONTE DO CARMO

OPTION AND LOAN AGREEMENTS WITH SUBSIDIARY OF HOCHSCHILD MINING PLC FOR THE SALE OF THE MONTE DO CARMO GOLD PROJECT FOR TOTAL CONSIDERATION OF US$60 MILLION (C$80 MILLION)

Proposed Transaction expected to strengthen balance sheet and addresses lack of funding available to development projects in the junior mining sector

Company will be well-positioned to sustain production rates and drive future growth via its operating Minera Don Nicolas gold mine in Argentina and completing a feasibility study at its Mont Sorcier iron development project in Quebec capable of producing 67% DRI grade iron concentrates

Transaction Highlights:

US$15 million 10% interest-bearing secured loan (“Signing Loan”) entered into effective on the date of news announcement (March 4, 2024), advanced in cash as follows:

US$7 million advanced by the Purchaser on the date of this announcement;

US$1 million to be advanced 60 days after the date of the First Advance; and

US$8 million to be advanced within two days following the mailing to Cerrado shareholders of the management information circular to be prepared in connection with the meeting of Cerrado shareholders at which management would seek the Cerrado Shareholder Approval.

Upon obtaining the Cerrado Shareholder Approval, the Signing Loan shall be deemed to be repaid in full by Cerrado and the amount of the Signing Loan shall be applied as part of the Consideration (as defined below).

US$10 million in cash, payable within 5 days of the date on which the Purchaser gives written notice of its exercise of the Option to Cerrado, or by March (16), 2025.

US$20 million which together with the Signing Loan and the Second Payment, the (“Consideration”) in cash payable upon either: (i) if necessary, the approval of the Proposed Transaction by Hochschild shareholders, which is to occur no later than June 30, 2025; or (ii) if Hochschild shareholder approval is not required, by no later than March 30, 2025.

In addition, Amarillo will make the following additional payments following the acquisition of the Project:

US$10 million in cash payable within 14 days of the second anniversary of the date on which Cerrado shareholders approve the Proposed Transaction (the “Second Anniversary Payment”); and

US$5 million in cash payable within 14 days of the earlier of: (i) the commencement of commercial production from the Project; and (ii) March 31, 2027 (the “Production Payment”).

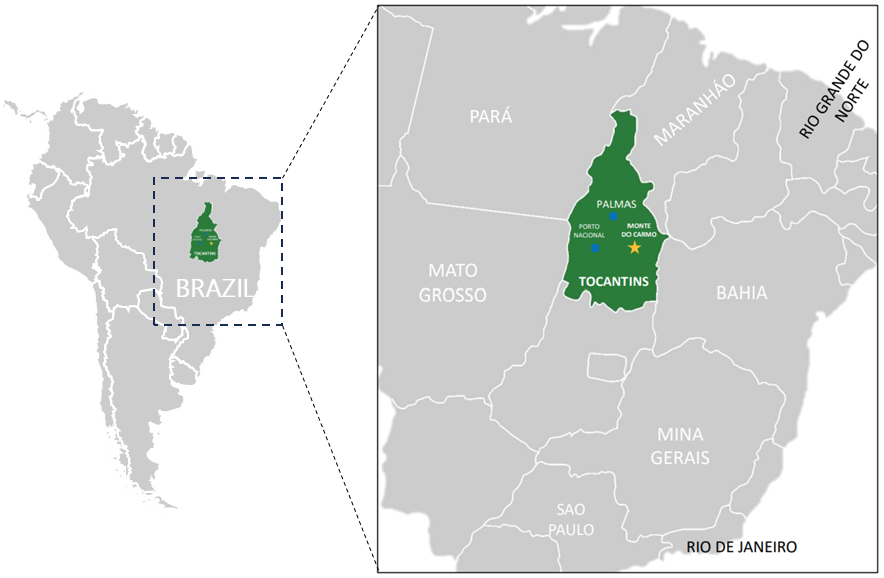

Location

Tocantins, Brazil

Ownership

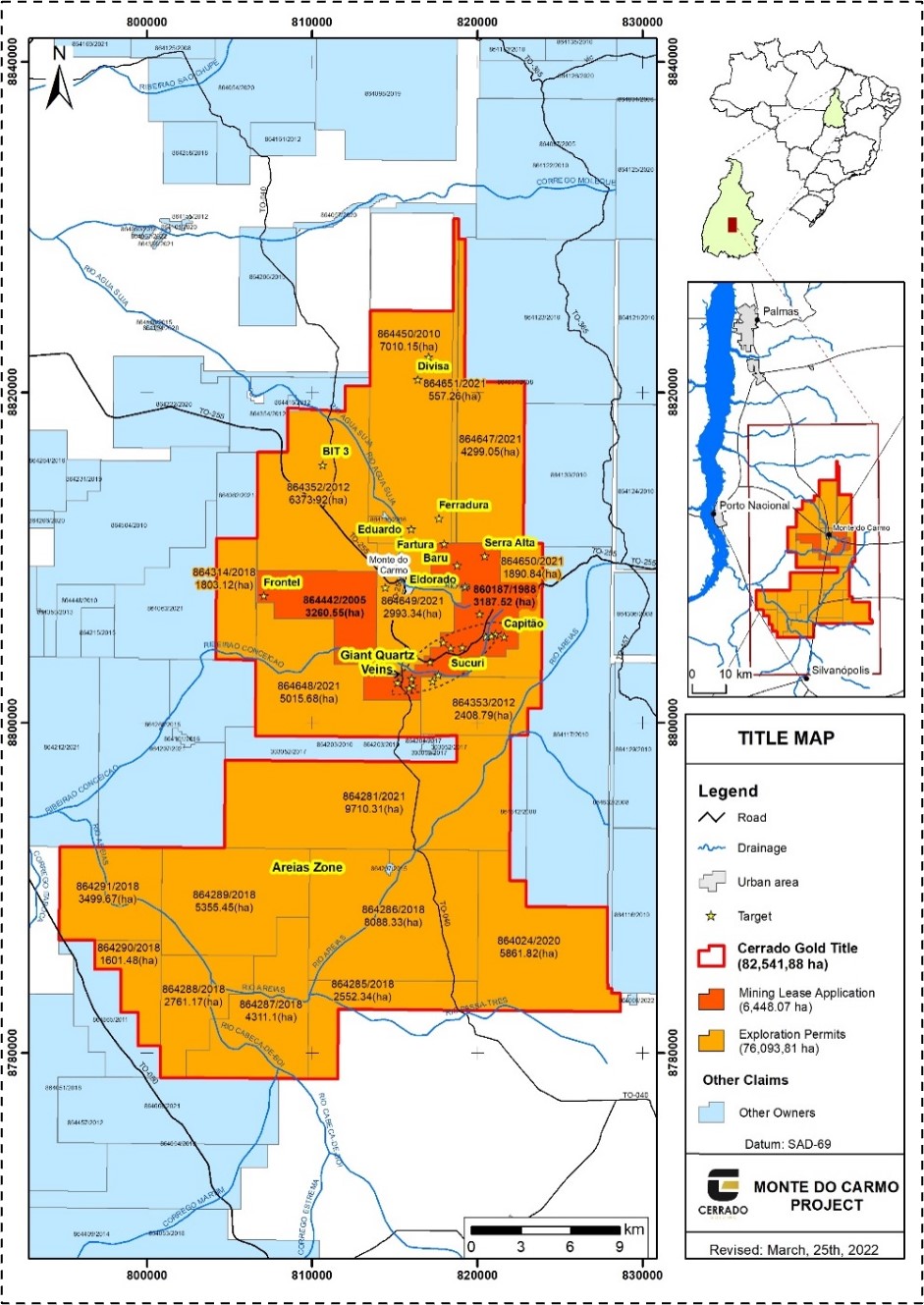

82,541 ha concession package

Status

Feasibility Complete

Deposit Type

Intrusion related gold

Infrastructure

Very accessible, skilled labor, water, power, paved roads

NPV5% After Tax

Free Cash Flow Over LoM

%

After Tax IRR

LoM Average Annual Production

LoM AISC in $USD

Identified Mineralized Trends Under Explored

Property Summary

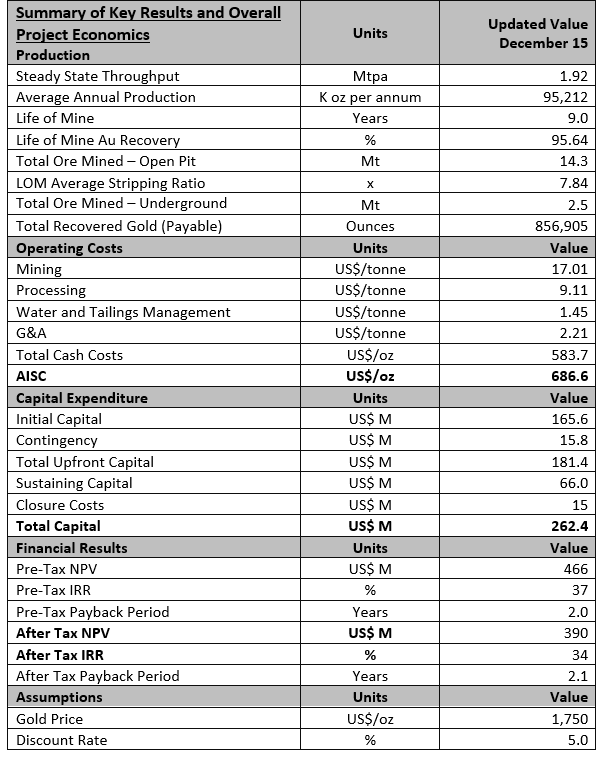

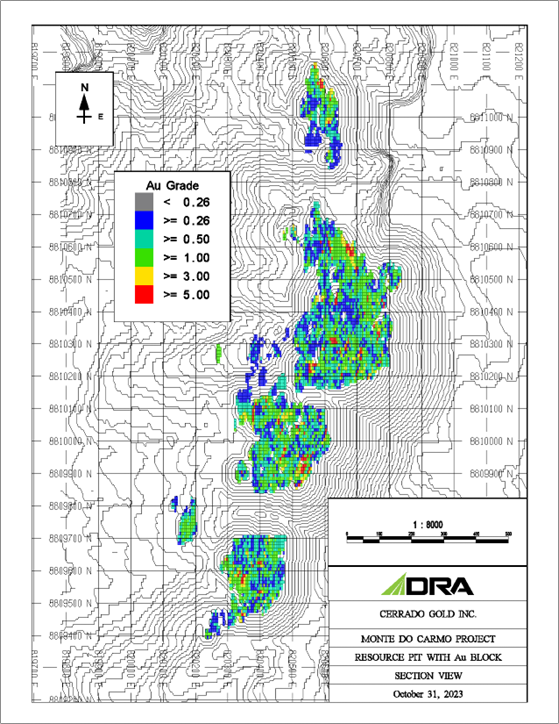

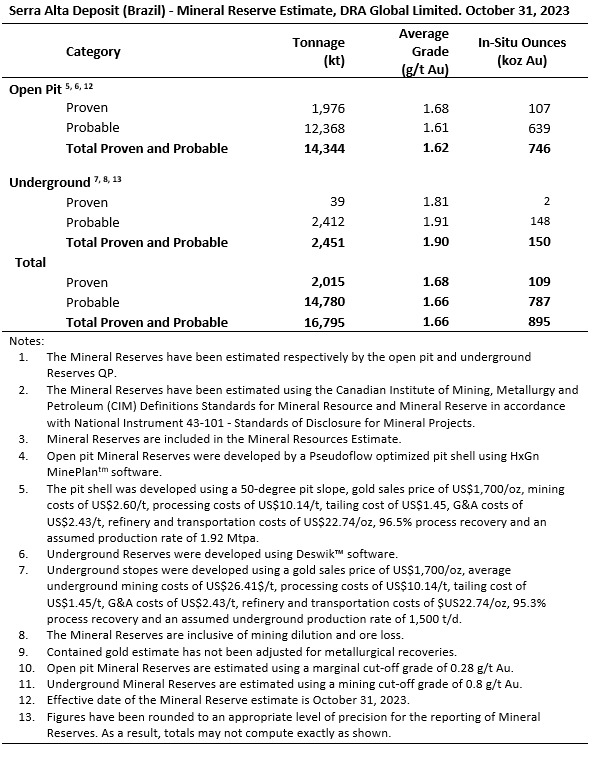

The Company is currently developing the known ore body at Serra Alta towards construction and production and conducting exploration at other targets on the property. The principal deposit, Serra Alta contains a Proven and Probable resource of 895 kozs and was subject to a Feasibility Study dated in October 31 2023. The Serra Alta Feasibility outlined a robust economic case for development of the Serra Alta deposit.

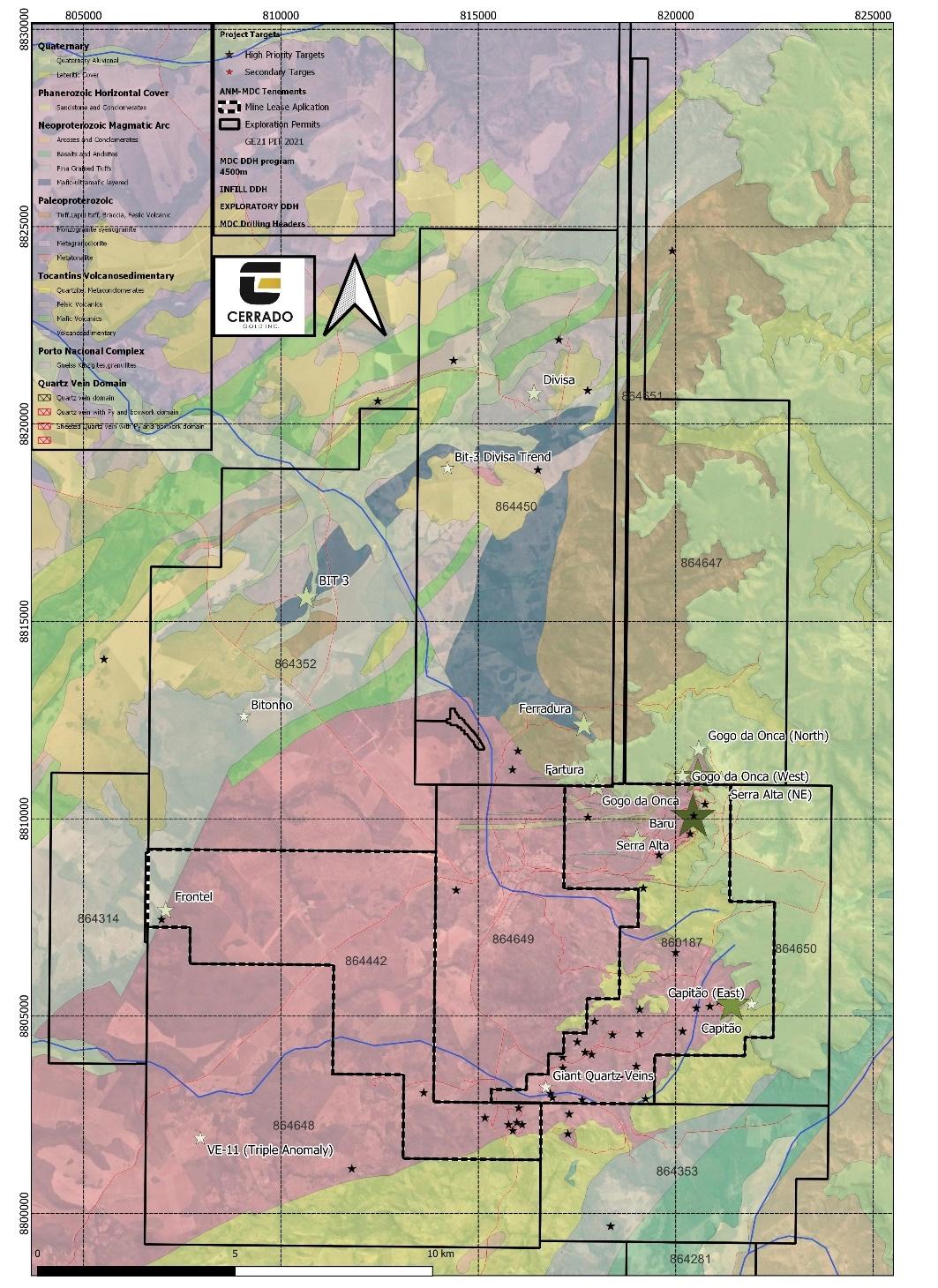

Throughout the 21 concessions and 82,541 ha hectares Cerrado Gold has identified an additional 30km of known mineralized trends that may hold the next “Serra Alta” style discovery. Several targets have been identified all with minimal drilling to date.

Geological Description & Exploration Program

Volcano Sedimentary Sequence of Upper Proterozoic age, intruded by a huge granite body of Lower Proterozoic age. The principal gold mineralization is associated to hydrothermally altered and sheared granite associated with low percentages in sulphides (Pyrite, Galena, Sphalerite and Chalcopyrite). Mineralization proceeds under the felsic volcanics and also of the phanerozoic sediments.

Mineral Reserve Estimate

Satellite Exploration

Exploration Potential: Finding The next 30k of Mineralized Trends:

Key exploration identifiers we look for :

-

- Granite Host

- NE Shear Zones

- Proximity to intrusive contact volcanics

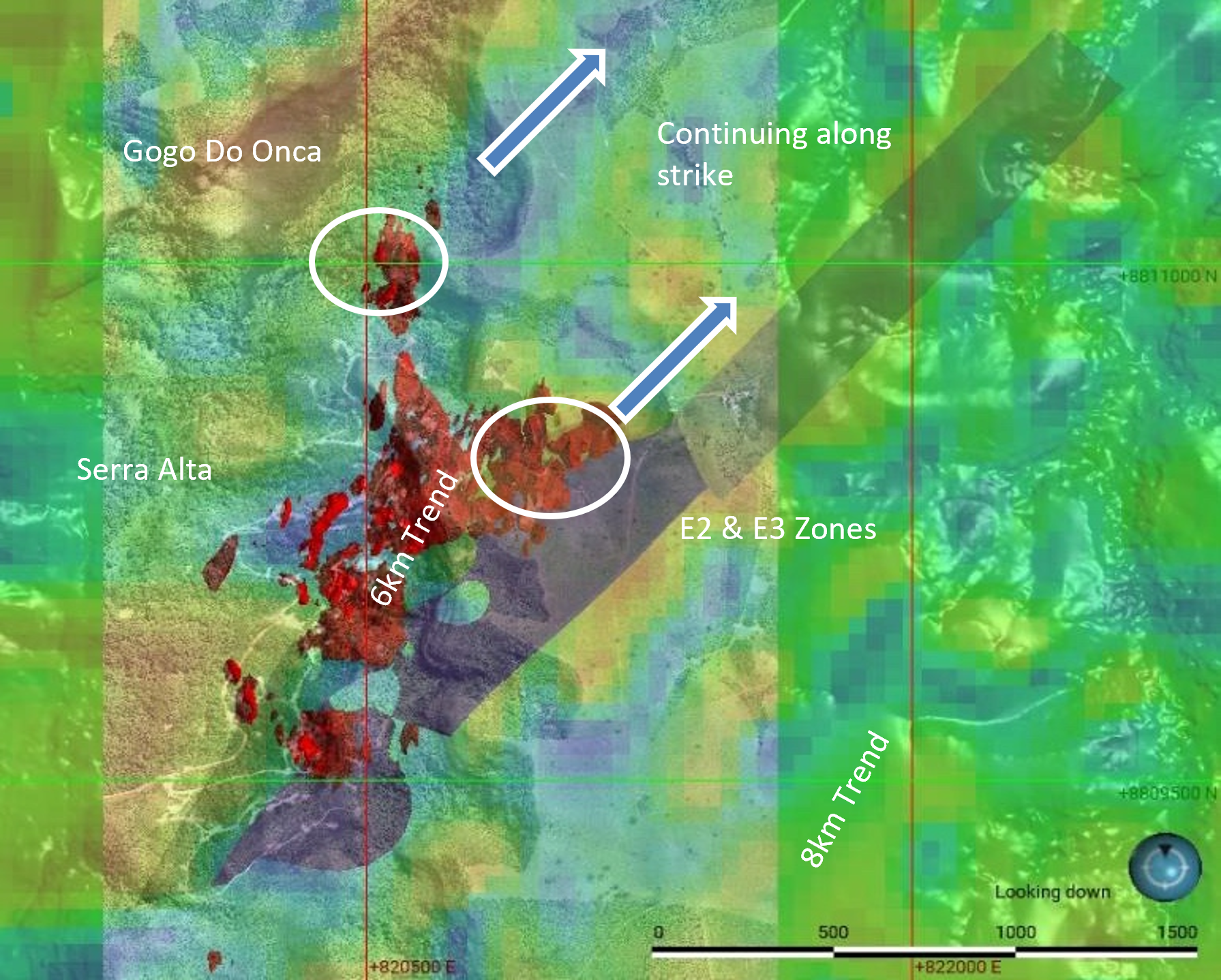

Serra Alta: Remains open

- Magnetic lineaments extending for >1km strike length

- Potentially represents the NE continuity of the DK2 shear (Host of E3 Zone)

- Targeting additional granitic hanging wall analogues to segmented zones in Serra Alta

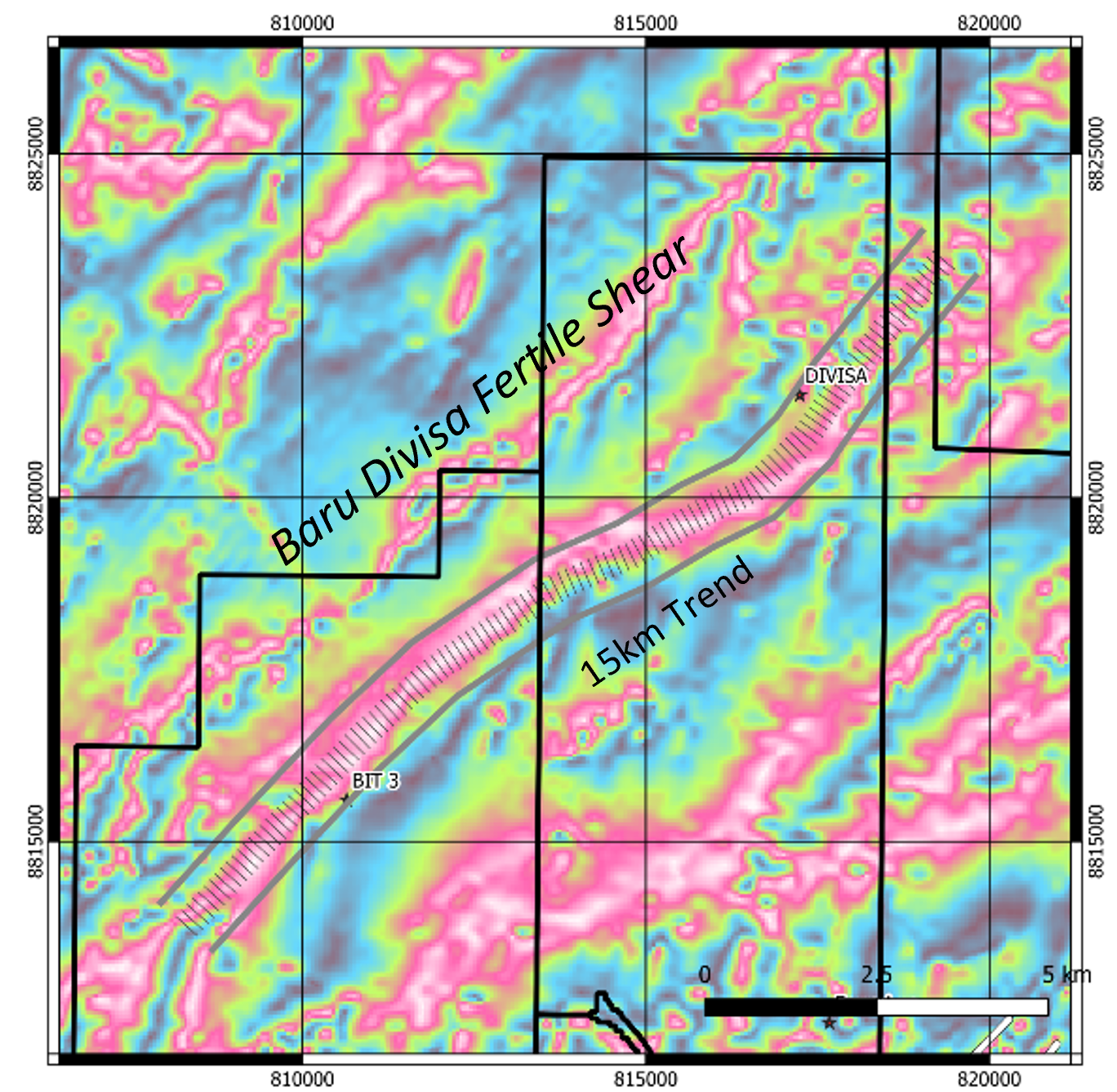

Bit-3: Largely untested Magnetic anomaly

- Large Geophysical anomaly that indicates a Huge Mafic/Ultramafic geological unit

- This target is related to a 15 km Shear zone strike and potential is open for exploration in depth

- Notable Results to date include:

- Hole FLD-01 – 12m@ 1.99 Au g/t

Mining Operations

The Monte do Carmo Project PEA considered an open pit operation with an average production rate of 1.92 Mtpa of ROM. Surface mining will use a contract mining fleet of hydraulic excavators, front-end loaders, and haul trucks, as well as correspondent ancillary equipment.

Site Infrastructure

68 kv Powerline south of the location for the process plant

Telecommunication mast in Monte do Carmo town. There is cellular reception in the immediate area, including the camp.

Community

The town of Monte do Carmo has a population of 6k people largely supported the surrounding agricultural industry (soy & corn). The town sits 55km southeast of Porto national and 95km south of Palmas, easily travelable by paved highway.

Technical Reports

Cerrado Gold has completed technical reports prepared in accordance with National Instrument 43-101.

NI 43-101 Technical Report

Feasibility Study – Monte do Carmo Gold Project, December 15, 2023

GE21 Report

Independent Technical Report – Update Preliminary Economic Assessment for Serra Alta Deposit, July 2021

Micon Report

An Updated Mineral Resource Estimate for the Serra Alta Deposit at the Monte do Carmo Project, Tocantins State, Brazil, July 21, 2021

TESTWORK Report

Metallurgical Tests with Samples from the orebodies of the Project: SERRA ALTA, June 2021

GE21 Report

Preliminary Economic Assessment for Serra Alta Deposit, April 23, 2020

Micon Report