First drill hole from 12,000-metre drill program focused on near mine and brownfield targets for potential high-grade resources

Toronto, Ontario–(Newsfile Corp. – March 15, 2021) – CERRADO GOLD (TSXV: CERT) (“Cerrado” or the “Company”) is pleased to announce the results from its first drill hole from its 12,000-metre exploration drill program starting at the Baritina Target, at its Minera Don Nicolás Project (“Minera Don Nicolás” or the “MDN Project”) located in Santa Cruz province, Argentina. The focus for the current 12,000-metre exploration program is to delineate new, high grade, near surface mineralization that can be brought into the production schedule in the near term. Results highlighted in this release are from the first drill hole, PA-D21-42. Cerrado has completed 2,127 metres of drilling to March 11. Additional drill results will be announced as assays are made available over the next few months.

Drill Hole Highlights:

PA-D21-42

- True thickness 17.00m grading 17.91g/t Au, starting from 56.00m

- including true thickness 6.50m grading 36.94g/t Au, from 66.50m

Mark Brennan, Co-Chairman and CEO commented “We are very pleased that our first exploration drill results have come back so strongly and believe this reinforces our long-held view of the highly prospective nature of the Minera Don Nicolas gold project. We look forward to continuing and expanding the exploration program to increase the overall resource with improved grade and greater overall tonnes that will continue to add value at Minera Don Nicholas.”

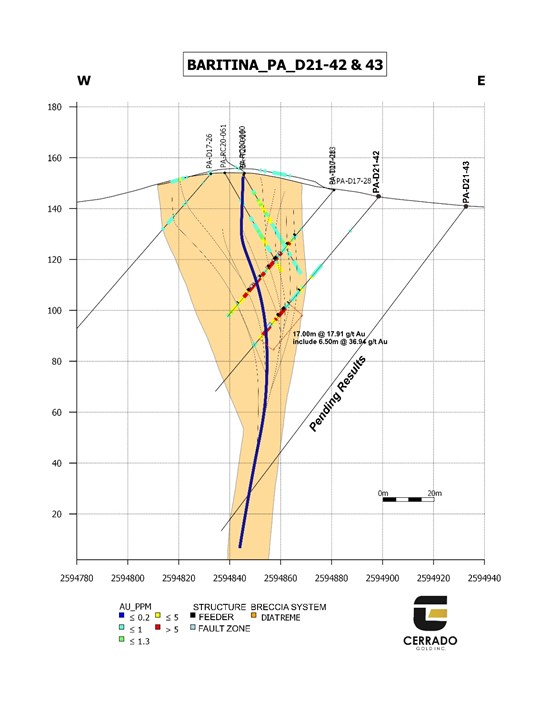

The current exploration drill program at the Minera Don Nicolás Project commenced on February 5th at the Baritina target, within the Paula-Andrea Prospect (Figure 1). The drill results reported in this press release were received March 11th, 2021 and represent complete results for hole PA-D21-42, which is the first of nine holes (PA-D21-42 thru 50) totaling 1,068 metres completed at Baritina (see Figure 2). Also, attached is a cross section of the mineralization (Figure 3). The assay results for the remaining holes are pending and will be released over the coming weeks as they become available. The drill rig has now moved 300 metres south and east onto the Chulengo Target, also a part of the Paula Andrea prospect, to test this highly prospective adjacent area, while awaiting additional assay results from Baritina. The current exploration drill program is expected to test numerous near mine and brownfield targets over the course of the next few months and is on track for completion by the end of June 2021.

Figure 1: location of drill target areas in the La Paloma Mining Group

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6185/77232_c3fae83994013a3f_002full.jpg

Previous drilling at Baritina includes 13 reverse-circulation and 5 diamond drill holes, which were used to target the new drilling program. PA-D21-42 was drilled approximately 30 metres downdip from previous drilling and results indicate that this drill hole has been successful in confirming an extension of the epithermal mineralization. Assay data from previous drilling are considered non-compliant and would not be used for resource estimation.

All nine drill holes intersected typical alteration zones associated with high level epithermal mineralization, including abundant silicification, clay alteration, hematite, jarosite and sulphides.

Figure 2: Current Baritina Exploration Program Drill Hole Location Map

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6185/77232_c3fae83994013a3f_003full.jpg

Figure 3: Cross-section of PA-D21-42 with the geology and current interpreted extent of the mineralisation

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6185/77232_c3fae83994013a3f_004full.jpg

Current Drill Program at MDN

The 2021 exploration program at Minera Don Nicolas is comprised of 12,000 metres of diamond drilling. This program will consist mainly of step-out and downdip drilling to target extensions of gold mineralization and a modest amount of infill drilling to upgrade resources. The primary areas of focus for the program will be to build on the numerous exploration targets that have been defined by limited historical drilling, such as the Esperanza and Paula Andrea (Baritina, Chulengo, Ariana, Carcol targets) Prospect (see Figure 3), and upgrade these to NI 43-101 compliant status. Given that these targets are close to the current, high grade, La Paloma mining area they are high priority in order to potentially add new resources. The current program is in addition to RC drilling undertaken by the mine for infill and grade control to extend the current mining areas of La Paloma and Martinetas both along strike and at depth.

Tables 1 summarizes the drill hole information. Table 2 summarizes the significant assay results.

Table 1. Drill hole information

| Hole_ID | Easting | Northing | Elevation | DEPTH (metres) | dip | Azimuth | |

| PA-D21-42 | 2594899 | 4713140 | 145 | 100 | – 50 | 270 | |

Table 2. Drill Hole Composites

| HOLE_ID | Interval | from | to | length (m) | True Length (m) | AU (g/t) |

| PA-D21-42 | 40.00 | 42.00 | 2.00 | 2.00 | 1.70 | |

| PA-D21-42 | and | 47.00 | 48.50 | 1.50 | 1.50 | 3.80 |

| PA-D21-42 | and | 56.00 | 73.00 | 17.00 | 17.00 | 17.91 |

| PA-D21-42 | including | 66.50 | 73.00 | 6.50 | 6.50 | 36.84 |

Quality Assurance and Quality Control

Analytical work was carried out Alex Stewart international, Argentina S.A. Labs (ASI). The facilities of the prep lab and assay lab are located in San Julian, 184 Km from MDN mine operations. MDN sends out 10% of samples to check at ALS international labs (ALS) with the prep lab located in Mendoza and assay labs in Lima, Peru and Vancouver, Canada. In the main laboratory ASI (Mendoza), the samples are systematically analyzed for gold (ppm) and silver (ppm) by fire assay (Au4-50 + AgICP-AR-39) regarding the over limits with fire assay results greater than 10 ppm, a second assay is applied including gravimetric finishing (FA50GRAV), with respect to silver, analyzes greater than 200ppm are carried out by Ag-FA50GRAV

ASI has routine quality control procedures which ensure that every batch of samples includes three sample repeats, two commercial standards and blanks. Cerrado used standard QA/QC procedures, when inserting reference standards and blanks, for the drilling program. The Reference material used are from CDN Resource Laboratories Ltd. Included in the batches following MDN internal protocols.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Robert Campbell, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

Minera Don Nicolás Overview

Minera Don Nicolás is located 1,625km south west of Buenos Aires, Argentina in the Deseado Massif region in the mining-friendly province of Santa Cruz. The project is comprised of several exploration concessions totaling 333,400 ha. The largest regional centre is Comodoro Rivadavia, which provides logistical and other support for the operations.

MDN Project is situated within the world renowned Deseado Massif where the underlying geology of the region is dominated by rhyolitic and andesitic volcanic and tuffaceous volcaniclastic lithologies of Middle to Upper Jurassic age (130 to 170 ma). It is criss-crossed by numerous extensive fault and fracture zones, which served as conduits for hydrothermal activity during periods of Jurassic volcanism. The result of this activity is a widespread network of shallow level mineralized “epithermal” fissure veins, breccias, and stock-work systems, many of which carry potentially economic Au and Ag mineralization. The Deseado Massif region is host to several epithermal gold-silver deposits and several multi-million-ounce gold deposits, including Cerro Vanguardia (Anglo Gold), Cerro Negro (Newmont GoldCorp), Cerro Morro (Yamana).

In February 2012, Minera IRL published a Full Feasibility Technical Report in accordance with National Instrument 43-101 (Filed on SEDAR, MINERA IRL LTD, Feb 16, 2012). Construction of the facilities was completed in 2017 and initial production began December 2017.

Current mining operations are conducted in two areas, the high grade La Paloma deposit and the Martinetas deposits, approximately 30km apart. Ore is processed through a 1,000 tpd CIL plant located near the Martinetas pit. The project currently supports 325 employees and contractors on a fly-in fly-out basis. Mineral Don Nicolás has strong regional and local community backing having signed agreements with the two neighboring communities.

Cerrado acquired the MDN Project property in March 2020 and undertook a fundamental review of the resource database and based upon a significant geological re-interpretation, engaged SRK to conduct an independent NI 43-101 updated resource technical report (August 2020) and which is available on the Cerrado Gold website and SEDAR.

Market Maker Agreement

In addition to the drill results outlined above, Cerrado also announces it has retained Integral Wealth Securities (“Integral”) to provide market-making services in accordance with TSX Venture Exchange (“TSX.V”) policies. Integral will trade shares of the Company on the TSX.V for the purposes of maintaining an orderly market and improving the liquidity of the Company’s shares.

In consideration of the services provided by Integral, the Company will pay integral a monthly fee of $5,000, plus, any reasonable costs and expenses, it incurs in connection with the services provided. The initial term of this agreement is for a period of not less than three (3) months. After 3 months, the agreement may be terminated by the Company on 30 days written notice. Integral will not receive shares or options as compensation pursuant to the agreement. However, Integral and its clients, may have or may acquire a direct interest in the securities of the Company.

Established in 2003, Integral is a private, Investment Industry Regulatory Organization of Canada (“IIROC”) licensed investment dealer headquartered in Toronto with offices in Calgary, Vancouver, Ottawa, Nanaimo (B.C.) and Sidney (B.C.), and can access all Canadian Stock Exchanges and Alternative Trading Systems. The capital and securities required for any trade undertaken by Integral as principal will be provided by Integral. Jaxon and Integral are unrelated and unaffiliated entities.

For further information please contact

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

[email protected]

Nicholas Campbell, CFA

Director, Corporate Development

Tel.: +1-905-630-0148

[email protected]

About Cerrado Gold

Cerrado Gold is a public gold producer and exploration company with gold production derived from its 100% owned Minera Don Nicolás mine in Santa Cruz province, Argentina. It also owns 100% of the assets of Minera Mariana in Santa Cruz province, Argentina. The company is also undertaking exploration at its 100% owned Monte Do Carmo project located in Tocantins, Brazil. For more information about Cerrado Gold please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado Gold. In making the forward- looking statements contained in this press release, Cerrado Gold has made certain assumptions, including, but not limited to ability of Cerrado to expand its drilling program at its Minera Don Nicolas Project and increase its resources. Although Cerrado Gold believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado Gold disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.