-

First production expected in second quarter 2023

-

Highlights for the project include:

-

Project represents the first stage of the MDN growth program to deliver production rate of approximately 90,000 ounces per annum and All In Sustaining Costs (“AISC”) below US$1,000 per ounce by 2024

-

Imminent growth to come from the development of heap leach operations at Las Calandrias and subsequently from the Martinetas area to process lower grade material

-

Las Calandrias first gold pour targeted for 2Q 2023

-

All engineering and testing completed, including Infill drilling, metallurgical testing and detailed design

-

Permitting is well advanced and all remaining approvals are expected during Q4 2022

-

Long-lead items have been ordered and construction to commence in Q4 2022 as planned

-

TORONTO, ON / ACCESSWIRE / October 18, 2022 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF) (“Cerrado” or the “Company”) is pleased to provide an update on the progress of its development of the gold heap leach project at the Las Calandrias deposit at its Minera Don Nicolas Mine located in Santa Cruz, Argentina (“MDN”). The heap leach production strategy follows extensive review of the potential to utilize alternative production technologies at MDN with the aim of mining lower grade material not being delivered to the CIL plant.

As initially outlined in a press release dated February 9, 2022, the addition of heap leach operations at MDN is targeted to increase production rates to 90,000 ozs per annum from the 2022 rate of approximately 50,000 ozs with a reduction in AISC to below $1,000 ozs by 2024. Production growth and cost reduction is planned from the development of two heap leach operations, firstly at Las Calandrias and secondly at the Martinetas area.

The initial heap leach operation located at Las Calandrias is expected to commence production in Q2 2023. The Company has budgeted approximately US$25 million in development capital in 2022 and 2023 to construct the project. Financing of development is expected to be predominately from sources internal to Argentina.

The Company has completed all metallurgical works, geotechnical testing of the site and a detailed design of the crushing circuit and heap leach pad. License and permit submissions have been completed and main orders for crushing and construction of the pad have been placed or are in final negotiations. First material is expected to be loaded on the pad towards the end of Q1 2023, and the first gold production is expected in Q2 2023.

Mark Brennan, CEO and Co-Chairman commented “As we prepare to enter the Construction Phase at the Las Calandrias project, work to date has confirmed our expectations of the viability of using heap leach methodologies to more fully exploit the known resources at MDN as seen at neighbouring operations. As a result, we are now one step closer to delivering on the first stage of our production growth strategy at MDN by utilizing lower grade material that would otherwise not be processed. The Calandrias project is the first step in our goal to reach production rates of 90,000 ounces per annum with reduced AISC’s at MDN by the end of 2023.”

Production Plan

The Company has developed an internal mine plan to process lower grade and transitional material through a purpose-built heap leach facility at Las Calandrias. Extraction will be conducted via open pit mining at an estimated life of mine strip ratio of 0.75:1. A plan view of the current pit design is shown below in Figure 1.

Figure 1. Las Calandrias Pit Design

Metallurgical Testing

The company has completed all Metallurgical work at Las Calandrias and expects an average recovery of 67% from processing the Oxide and Transitional material. Recoveries in the primary zone are currently around 36% on average, with grades 30% higher than in the oxide and mixed zones. Testing to date has confirmed the following Au recovery rates for each ore type.

|

Ore Type |

Au Recovery |

|

Oxide |

70% |

|

Mixed or Transitional |

50% |

|

Primary |

36% |

Plant Design

The Las Calandrias plant will be constructed to have a 2Mtpa capacity through a two-stage crushing process and pad design that will be built in stages. Water required for processing is currently expected to be sourced through third party purchases, however, ongoing hydrological drilling could add additional proprietary sources which would deliver a positive impact on operating costs and productions rates. A layout of the pad and ancillary infrastructure is shown below in Figure 2.

Figure 2. Pad and Plant Design

Las Calandrias Infill

During late 2021 and in 2022 MDN completed an infill drill program to support its understanding of the resource and to make a development decision. During this program a further 3,582m were drilled (1,320m DDH and 2,262m RC) in addition to the historical holes and assays.

A summary of the Total Exploration holes at the Las Calandrias property are presented below:

|

Hole Type |

# Holes |

Metres |

|

DDH |

210 |

24,583 |

|

RC |

45 |

2,424 |

|

Grand |

255 |

27,007 |

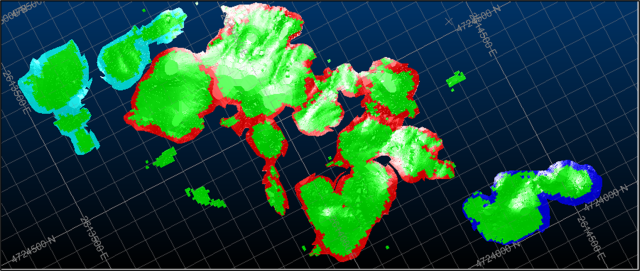

The company has received assays for all drilling to date at Las Calandrias. Drill hole locations and composites are provided in in Figure 3. and Tables 2. and 3. below.

Figure 3. Las Calandrias Plan view and drill hole locations

Table 2. Drill Hole locations

|

Hole_ID |

UTM E |

UTM N |

Elevation |

Depth |

Dip |

Azimuth |

|

E-D21-093 |

2614267 |

4724147 |

153.7 |

60 |

61 |

39 |

|

E-D21-094 |

2614322 |

4724144 |

151.7 |

60 |

61 |

38 |

|

E-D21-095 |

2614299 |

4724114 |

149.9 |

60 |

60 |

40 |

|

E-D21-096 |

2614343 |

4724106 |

151.5 |

60 |

60 |

38 |

|

E-D21-097 |

2614378 |

4724057 |

154.7 |

60 |

60 |

40 |

|

E-D21-098 |

2614353 |

4724075 |

149.6 |

60 |

60 |

40 |

|

E-RC21-001 |

2614295 |

4724173 |

156.3 |

54 |

60 |

40 |

|

E-RC21-002 |

2614287 |

4724232 |

157.9 |

54 |

60 |

40 |

|

E-RC21-003 |

2614252 |

4724221 |

163.7 |

54 |

60 |

40 |

|

E-RC21-004 |

2614225 |

4724238 |

166.3 |

54 |

60 |

40 |

|

E-RC21-005 |

2614236 |

4724271 |

165.7 |

54 |

60 |

40 |

|

E-RC21-006 |

2614208 |

4724315 |

163.9 |

54 |

60 |

40 |

|

E-RC21-007 |

2614156 |

4724267 |

168.5 |

54 |

60 |

40 |

|

E-RC21-008 |

2614092 |

4724226 |

163.9 |

54 |

60 |

20 |

|

E-RC21-009 |

2614067 |

4724268 |

159.4 |

54 |

60 |

40 |

|

E-RC21-010 |

2614121 |

4724284 |

163.9 |

54 |

60 |

40 |

|

E-RC21-011 |

2614014 |

4724269 |

163.6 |

54 |

60 |

40 |

|

E-RC21-012 |

2614011 |

4724211 |

157.8 |

54 |

60 |

40 |

|

E-RC21-013 |

2614374 |

4724097 |

150.8 |

54 |

60 |

40 |

|

E-RC21-014 |

2614029 |

4724192 |

153.3 |

54 |

60 |

40 |

|

LC-D21-001 |

2613898 |

4724641 |

184.8 |

60 |

59 |

21 |

|

LC-D21-002 |

2614110 |

4724593 |

174.8 |

60 |

61 |

20 |

|

LC-D21-003 |

2614122 |

4724624 |

169.2 |

60 |

61 |

18 |

|

LC-D21-004 |

2614133 |

4724575 |

169.5 |

60 |

61 |

20 |

|

LC-D21-005 |

2614150 |

4724522 |

167.0 |

60 |

61 |

19 |

|

LC-D21-006 |

2614160 |

4724556 |

164.4 |

60 |

62 |

20 |

|

LC-D21-007 |

2614170 |

4724587 |

162.9 |

60 |

61 |

20 |

|

LC-D21-008 |

2614176 |

4724508 |

169.5 |

60 |

61 |

20 |

|

LC-D21-009 |

2614166 |

4724483 |

172.1 |

60 |

61 |

20 |

|

LC-D21-010 |

2614208 |

4724468 |

164.6 |

60 |

61 |

10 |

|

LC-D21-011 |

2614220 |

4724505 |

164.6 |

60 |

61 |

20 |

|

LC-D21-012 |

2614240 |

4724481 |

165.6 |

60 |

62 |

19 |

|

LC-D21-013 |

2614277 |

4724475 |

166.5 |

60 |

61 |

21 |

|

LC-D21-014 |

2614259 |

4724431 |

165.7 |

60 |

61 |

21 |

|

LC-D21-015 |

2614316 |

4724411 |

155.8 |

60 |

61 |

21 |

|

LC-D21-016 |

2614340 |

4724373 |

151.8 |

60 |

60 |

20 |

|

LC-RC21-001 |

2614142 |

4724384 |

166.8 |

54 |

60 |

20 |

|

LC-RC21-002 |

2614094 |

4724391 |

172.0 |

54 |

60 |

20 |

|

LC-RC21-003 |

2614068 |

4724350 |

168.1 |

54 |

60 |

20 |

|

LC-RC21-004 |

2614000 |

4724349 |

175.9 |

54 |

60 |

20 |

|

LC-RC21-005 |

2613980 |

4724532 |

183.4 |

54 |

60 |

20 |

|

LC-RC21-006 |

2613980 |

4724409 |

173.7 |

54 |

60 |

20 |

|

LC-RC21-007 |

2614069 |

4724449 |

178.9 |

54 |

60 |

20 |

|

LC-RC21-008 |

2614111 |

4724480 |

172.7 |

54 |

60 |

20 |

|

LC-RC21-009 |

2614013 |

4724479 |

180.7 |

54 |

60 |

20 |

|

LC-RC21-010 |

2613996 |

4724499 |

179.4 |

54 |

60 |

20 |

|

LC-RC21-011 |

2613967 |

4724497 |

181.9 |

54 |

60 |

20 |

|

LC-RC21-012 |

2613933 |

4724495 |

177.4 |

54 |

60 |

20 |

|

LC-RC21-013 |

2613963 |

4724690 |

182.9 |

54 |

60 |

20 |

|

LC-RC21-014 |

2613925 |

4724709 |

185.2 |

54 |

60 |

20 |

|

LC-RC21-015 |

2613908 |

4724666 |

184.7 |

54 |

60 |

20 |

|

LC-RC21-016 |

2613899 |

4724640 |

185.1 |

54 |

60 |

20 |

|

LC-RC21-017 |

2613826 |

4724592 |

179.7 |

54 |

60 |

20 |

|

LC-RC21-018 |

2613816 |

4724567 |

176.7 |

54 |

60 |

20 |

|

LC-RC21-019 |

2613768 |

4724714 |

183.9 |

54 |

60 |

20 |

|

LC-RC21-020 |

2613781 |

4724741 |

185.3 |

54 |

60 |

20 |

|

LC-RC21-021 |

2613790 |

4724792 |

177.9 |

54 |

60 |

20 |

|

LC-RC21-022 |

2613736 |

4724791 |

176.8 |

48 |

60 |

20 |

|

LC-RC21-023 |

2613758 |

4724760 |

181.3 |

54 |

60 |

20 |

|

LC-RC21-024 |

2613568 |

4724821 |

160.0 |

54 |

60 |

20 |

|

LC-RC21-025 |

2613576 |

4724739 |

169.6 |

54 |

60 |

20 |

|

LC-RC21-026 |

2614353 |

4724411 |

156.2 |

54 |

60 |

20 |

|

LC-RC21-027 |

2614330 |

4724452 |

158.6 |

54 |

60 |

20 |

|

LC-RC21-028 |

2614245 |

4724399 |

159.9 |

54 |

60 |

20 |

|

LC-RC21-029 |

2613256 |

4724445 |

154.9 |

54 |

60 |

20 |

|

LC-RC21-030 |

2613283 |

4724373 |

152.6 |

54 |

60 |

20 |

|

LC-RC21-031 |

2613434 |

4724513 |

153.4 |

54 |

60 |

20 |

|

LC-RC21-032 |

2613528 |

4724460 |

155.8 |

54 |

60 |

20 |

|

LC-RC21-033 |

2613555 |

4724370 |

154.7 |

54 |

60 |

20 |

|

LC-RC21-034 |

2613610 |

4724436 |

158.3 |

54 |

60 |

20 |

|

LC-RC21-035 |

2613090 |

4724381 |

151.6 |

54 |

60 |

20 |

*Collar coordinates by GNSS TP-20 UTM Coordinates, Datum: SAD69 / zone 22S.

*Azimuth Set by compass

*Dip and drill hole trajectory by DEVIFLEX Devico

Table 3. Drill Hole Composites

|

Holeid |

Domain |

from |

to |

Au_ppm |

Ag ppm |

|

E-D21-095 |

Transition |

8.0 |

22.0 |

0.76 |

2.66 |

|

E-D21-096 |

Transition |

22.7 |

28.1 |

0.85 |

4.39 |

|

E-D21-097 |

Oxide |

2.0 |

16.0 |

1.02 |

11.21 |

|

E-D21-097 |

Transition |

16.0 |

34.0 |

0.83 |

6.56 |

|

E-D21-097 |

Primary |

54.0 |

60.0 |

1.78 |

10.07 |

|

E-D21-098 |

Oxide |

0.2 |

8.0 |

0.57 |

5.57 |

|

E-D21-098 |

Transition |

14.0 |

24.0 |

0.59 |

5.92 |

|

E-RC21-004 |

Primary |

20.0 |

26.0 |

1.54 |

10.53 |

|

E-RC21-005 |

Oxide |

2.0 |

20.0 |

4.56 |

16.38 |

|

E-RC21-006 |

Oxide |

16.0 |

30.0 |

1.24 |

7.11 |

|

E-RC21-006 |

Primary |

30.0 |

36.0 |

1.85 |

6.83 |

|

E-RC21-008 |

Oxide |

0.0 |

34.0 |

0.70 |

2.36 |

|

E-RC21-009 |

Oxide |

18.0 |

36.0 |

0.54 |

1.34 |

|

E-RC21-009 |

Primary |

40.0 |

54.0 |

1.54 |

6.19 |

|

E-RC21-010 |

Oxide |

12.0 |

32.0 |

1.32 |

4.88 |

|

E-RC21-012 |

Oxide |

2.0 |

10.0 |

0.44 |

2.13 |

|

E-RC21-012 |

Transition |

16.0 |

26.0 |

1.01 |

4.75 |

|

E-RC21-012 |

Primary |

38.0 |

44.0 |

3.97 |

13.87 |

|

E-RC21-013 |

Oxide |

0.0 |

16.0 |

1.99 |

11.66 |

|

E-RC21-014 |

Oxide |

6.0 |

18.0 |

0.66 |

1.57 |

|

LC-D21-003 |

Oxide |

1.2 |

12.0 |

0.49 |

1.08 |

|

LC-D21-005 |

Oxide |

8.0 |

18.0 |

0.59 |

1.08 |

|

LC-D21-005 |

Oxide |

24.0 |

38.0 |

0.39 |

0.53 |

|

LC-D21-008 |

Oxide |

16.0 |

21.4 |

0.81 |

2.99 |

|

LC-D21-009 |

Oxide |

6.0 |

16.0 |

0.47 |

0.56 |

|

LC-D21-009 |

Transition |

22.0 |

29.0 |

0.49 |

2.13 |

|

LC-D21-011 |

Oxide |

2.0 |

10.0 |

0.39 |

1.01 |

|

LC-D21-012 |

Oxide |

0.0 |

14.0 |

0.76 |

2.00 |

|

LC-D21-013 |

Oxide |

18.0 |

27.5 |

0.30 |

0.98 |

|

LC-D21-013 |

Transition |

27.5 |

33.4 |

0.55 |

1.62 |

|

LC-D21-014 |

Oxide |

6.0 |

22.0 |

0.64 |

1.76 |

|

LC-D21-014 |

Primary |

54.0 |

60.0 |

2.17 |

3.70 |

|

LC-RC21-001 |

Oxide |

2.0 |

10.0 |

1.40 |

3.07 |

|

LC-RC21-001 |

Oxide |

30.0 |

46.0 |

0.61 |

7.86 |

|

LC-RC21-001 |

Primary |

46.0 |

54.0 |

1.82 |

12.67 |

|

LC-RC21-002 |

Oxide |

14.0 |

32.0 |

0.60 |

10.36 |

|

LC-RC21-003 |

Oxide |

38.0 |

46.0 |

0.44 |

8.58 |

|

LC-RC21-004 |

Oxide |

28.0 |

36.0 |

0.66 |

4.40 |

|

LC-RC21-004 |

Oxide |

42.0 |

52.0 |

0.50 |

18.16 |

|

LC-RC21-007 |

Oxide |

20.0 |

36.0 |

0.66 |

4.59 |

|

LC-RC21-007 |

Oxide |

38.0 |

44.0 |

0.32 |

2.17 |

|

LC-RC21-008 |

Oxide |

4.0 |

16.0 |

0.53 |

4.25 |

|

LC-RC21-012 |

Oxide |

12.0 |

18.0 |

0.37 |

5.10 |

|

LC-RC21-013 |

Primary |

44.0 |

52.0 |

0.81 |

88.80 |

|

LC-RC21-017 |

Oxide |

2.0 |

8.0 |

0.94 |

1.93 |

|

LC-RC21-017 |

Primary |

48.0 |

54.0 |

1.00 |

54.66 |

|

LC-RC21-018 |

Primary |

46.0 |

54.0 |

0.84 |

33.13 |

|

LC-RC21-019 |

Oxide |

46.0 |

52.0 |

0.54 |

14.97 |

|

LC-RC21-022 |

Oxide |

8.0 |

22.0 |

0.53 |

7.24 |

|

LC-RC21-022 |

Oxide |

26.0 |

34.0 |

1.05 |

16.82 |

|

LC-RC21-024 |

Oxide |

2.0 |

20.0 |

0.63 |

21.60 |

|

LC-RC21-028 |

Oxide |

8.0 |

22.0 |

0.67 |

3.12 |

Economic cut-off grade applied in the composites varies according to Domain. Primary; 0.3 g/t Au; Transition: 0.4 g/t Au; and Primary 0.81 g/t Au

Quality Assurance and Quality Control

Analytical work of MDN reported drill holes was carried out by Alex Stewart international, Argentina S.A. Labs (ASI). The facilities of the prep lab and assay lab are in San Julian, 184 Km from MDN mine operations. MDN sends out 10% of samples to check at ALS international labs (ALS) with the prep lab located in Mendoza and assay labs in Lima, Peru and Vancouver, Canada. In the main laboratory ASI (Mendoza), the samples are systematically analyzed for gold (ppm) and silver (ppm) by fire assay (Au4-50 + AgICP-AR-39) regarding the over limits with fire assay results greater than 10 ppm, a second assay is applied including gravimetric finishing (FA50GRAV), with respect to silver, analyzes greater than 200ppm are carried out by AgFA50GRAV.

ASI has routine quality control procedures which ensure that every batch of samples includes three sample repeats, two commercial standards and blanks. Cerrado used standard QA/QC procedures, when inserting reference standards and blanks, for the drilling program. The Reference material used are from CDN Resource Laboratories Ltd. Included in the batches following MDN internal protocols.

The historic database was verified by AGP in 2018. In addition, AGP verified the assay data provided by the company against the assay certificates provided by the laboratories: ALS (Mendoza) and ASi (Mendoza), as provided by New Dimension. AGP verified approximately 20% of New Dimension’s database across all drill campaigns with any errors corrected prior to finalizing the drillhole database.

SRK undertook an assessment of the geological model in 2021 and made a number of recommendations that have since been adopted. MDN has reviewed and updated the information into the geological model with the latest drillhole information and using the recommendations of SRK.

Metallurgical testing work was carried out by National University of San Juan, Institute of Mining Investigations. MDN send half core samples for sample preparation to the lab. The laboratory has routine quality control procedures which ensure that testing is to Approved and recognised Standards.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Clinton Swemmer, P.Eng., Vice President, Technical Services for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

|

Mark Brennan |

David Ball |

|

CEO and Co Chairman |

Vice President, Corporate Development |

|

Tel: +1-647-796-0023 |

Tel: +1-647-796-0068 |

About Cerrado

Cerrado is a Toronto based gold production, development and exploration company focused on gold projects in the Americas. The Company is the 100% owner of both the producing Minera Don Nicolás mine in Santa Cruz province, Argentina, and the highly prospective development project, Monte Do Carmo located in Tocantins State, Brazil.

At Minera Don Nicolas, Cerrado is maximising asset value through further operation optimization and continued production growth. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package.

At Monte Do Carmo, Cerrado is rapidly advancing the Serra Alta deposit through Feasibility and production. The Serra Alta deposit Indicated Resources of 541 kozs of contained gold and Inferred Resources of 780 kozs of contained gold. The Preliminary Economic Assessment demonstrates robust economics as well as the potential to be one of the industry’s lowest cost producers. Cerrado also holds an extensive and highly prospective 82,542 ha land package at Monte Do Carmo.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the timing of production, rates of production, operating costs and capital costs of the Las Calandrias project. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.