- Long-Term Gold Price US$1,550

- 7 Year annual production targeted at approx. 103,000 ounces gold

- Initial Capex US$110 million (including US$25 million contingency)

- Total after tax free cash flow estimated US$78 million per annum (Cumulative US$548 million)

- Average Cash Costs of US$480.95/oz; Avg AISC US$498/oz

- Potential to be amongst lowest 10% of AISC cost mines in the world

- Upside potential from continued drilling & resource expansion

PEA Summary Results

| PEA Summary Table | ||

| All Figures in US$ unless otherwise noted | ||

| NPV 8% After Tax | $ millions | $377 |

| NPV 5% After Tax | $ millions | $432 |

| IRR After Tax | % | 76.4 |

| Long Term gold price | US$/oz Au | $1,550 |

| Initial Capex | $ millions | $110 |

| Sustaining LOM Capital | $ millions | 1.6 |

| LOM average annual Production | koz | 103.5 |

| LOM Annual Tonnes mined | MM tonnes | 1.888 |

| LOM Stripping Ratio | waste:ore | 7.79:1 |

| Opex | $/t | $26.39 |

| Avg Cash Cost | US$/oz Au | $480 |

| Avg LOM AISC | US$/oz Au | $498 |

| Royalties | % | 3% |

| Life of Mine | years | 7 |

| Payback | years | 1.5 |

| Mine closure provision | $ millions | $11.25 |

Toronto, Ontario–(Newsfile Corp. – October 14, 2020) – CERRADO GOLD (“Cerrado” or the “Company”) is pleased to announce the results of a National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) Preliminary Economic Assessment (“PEA”) on the current resources defined at the Serra Alta deposit at its Monte do Carmo gold project in Tocantins State, Brazil. The work is being undertaken by GE21 Consultoria Mineral Ltda (“GE21”). The final PEA report is expected to be completed and available on SEDAR by mid-October 2020.

Mark Brennan, CEO of Cerrado Gold commented, “We are extremely pleased that the results of the PEA have exceeded even our own expectations of the significant potential we see at the Monte do Carmo gold project. The Serra Alta deposit is the first of 5 analogue deposits Cerrado is developing and while current resources remain relatively modest in scale, the completion of the PEA underscores the extremely robust economics that should only improve as the resources continue to grow with further drilling. News of a new 17,000 metre drill program is expected imminently. We continue to view Serra Alta as an emerging world class, open pit-low cost, gold deposit within a larger multi-deposit district.”

Project Summary

The Monte do Carmo (MDC) Gold Project is located in the state of Tocantins, Brazil, 2 kilometres east of the town of Monte do Carmo which is 40Km from Porto Nacional (50,000 inhabitants) through paved roads and 100Km from Palmas, the Capital of Tocantins State (250,000 inhabitants). The Serra Alta deposit is currently the main focus of exploration at the project. The MDC project has good access to all necessary infrastructure: paved roads, energy, a 69 KW electric power line, water supply and an international airport, and is well supported by the local community.

Figure 1

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6997/65860_b5ac5ec474e82bf0_003full.jpg

Mining

The mine design is based on using standard open pit mining techniques of drill, blast and haul using contract mining to reduce upfront capital needs. GE21 has developed a mine plan which processes 13.23 million tonnes of the current resource base over a 7-year mine life at an average strip ratio of 7.79 to 1. Mining will reach a peak of material movement of approximately 1.89 million tonnes per annum. Mining costs are estimated at US$1.65/t of material moved. The low mining costs reflects short haul distances and easy access to the deposit area. These costs are in line with costs of other regional operators.

Figure 2

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6997/65860_b5ac5ec474e82bf0_004full.jpg

Figure 3

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6997/65860_b5ac5ec474e82bf0_005full.jpg

Metallurgy and Processing

As outlined in the PEA technical report, the initial metallurgical test work supports the gold recovery by gravity concentration followed by tailing flotation. Both concentrate coming from gravity and flotation are leached in an Intense Leaching Reactor (ILR). The results of the test work confirmed the recoveries of 97%. The processing plant designed for Monte do Carmo is a simple gravity circuit with a small flotation and leach plant to recover the gold using standard equipment and technologies.

Infrastructure

The site is located with access to all weather roads, water, low cost grid and power to support project development with only modest infrastructure capital needs. In addition, the site is close to numerous large population centres to provide a daily workforce and auxiliary services to the site.

Capital Costs

Upfront capital costs are estimated at US$110 million with a pay back of 1.5 years with an after-tax IRR of 76.4%. Sustaining capital is estimated at US$1.6 million over the life of mine. Capital costs include a 30% continency for equipment and for plant and infrastructure. Capital costs assume the use of contract mining negating the need for acquisition of a mining fleet given the relatively short mine life presented with current resources.

Operating Costs

The LOM operating costs are estimated at a total ofUS$26.39/t of ROM material processed. Operating costs are expected to be low, benefiting from the free gold in the ore – no refractory ore has been identified, outstanding gravimetric recoveries are expected based on met tests performed which indicate a simple processing circuit, dry stacking and commingling of tails is applicable, the overall jurisdiction and good logistics both for consumables and people.

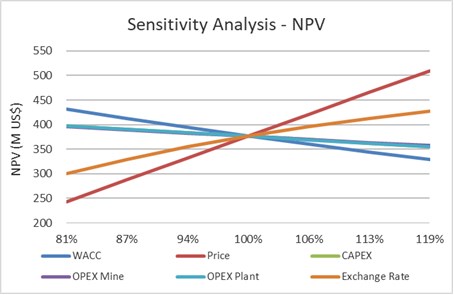

Overall Project Economics

The overall project shows potentially robust economic results with an after tax NPV at an 8% discount rate of US$377 million and IRR of 76.4% at a flat gold price of $1,550/oz. Using a 5% discount rate the NPV rises to US$432 million. Project economics are based on a potential 7-year mine life with a 1.5-year payback period, with positive after-tax cash flow commencing in Year 1. Total cumulative, after tax free cash flow over the life of mine is estimated at US$548 million (US$78 million per annum) at a $1,550/oz gold price.

Figure 4

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/6997/65860_b5ac5ec474e82bf0_006full.jpg

Mineral Resource Estimate

The PEA is based on the current NI 43-101 compliant Mineral Resource Estimate completed by MICON International Limited, with an effective date of December 5, 2018 outlined below. It should be noted that Mineral resources which are not mineral reserves do not have demonstrated economic viability.

To view an enhanced version of this table, please visit:

https://orders.newsfilecorp.com/files/6997/65860_b5ac5ec474e82bf0_007full.jpg

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by Canadian Securities Administrators’ National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Cerrado Gold Inc. will within 45 days, publish a Technical Report prepared in accordance with NI 43-101 that documents the PEA study and supports the current disclosure.

Independent Qualified Persons

Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), MAIG, director of GE21 Consultoria Mineral Ltda, Paulo Roberto Bergmann, Mining Engineer, BSc (Mine Eng), FAusIMM associated to GE21 Consultoria Mineral Ltda, and B. Terrence Hennessey, P.Geo., Vice President of MICON International Limited, are the Qualified Persons as defined in NI 43-101 responsible for the Technical Report and are all independent of the Company.

Quality Assurance Quality Control:

The scientific and technical information in this press release has been reviewed and approved by Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), MAIG, director of GE21 Consultoria Mineral Ltda, Paulo Roberto Bergmann, Mining Engineer, BSc (Mine Eng), FAusIMM, associated to GE21 Consultoria Mineral Ltda, and B. Terrence Hennessey, P.Geo., Vice President of MICON International Limited, all of whom are Qualified Persons as defined in NI 43-101.

About Cerrado Gold

Cerrado Gold is a private gold production and exploration company with gold production derived from its 100% owned Minera Don Nicolas mine in Santa Cruz province, Argentina. The company is also undertaking exploration at its 100% owned Monte Do Carmo project located in Tocantins, Brazil. For more information about Cerrado Gold please visit our website at www.ceradogold.com.

About GE21

GE21 is a specialized and independent mineral consulting firm based on a multi-disciplinary technical team, which offers services covering most project development stages in the mining sector.

The senior staff and Board of Directors have extensive technical and operational experience, based on collaboration with relevant companies in the fields of exploration and mineral consulting in Brazil going back to the 1980’s.

GE21’s services cover the entire mining cycle, from business strategies and target generation and investments to mine closure. GE21 routinely provides services for mineral exploration, project development, geological valuations, and resource and reserve estimation and certification according to international standards, including JORC and NI 43-101. In addition, GE21 also serves the mining industry by working with operators in connection with mine planning and mine optimization, technical and economic studies as well as technical audits and the application of best market practices advocated by various international codes.

For further information please contact

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

www.cerradogold.com

Cautionary Statement on Forward-Looking Information

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, uncertainty over the outcome of any litigious matters, the Company’s objectives, goals or future plans, statements regarding exploration results and exploration plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.